Independent insights

for the digital assets investor

Because "DYOR" is exhausting.

Ride the upside with our view of the market delivered daily, directly to your inbox.

Read by professionals at:

Research & Alerts

Empower your investment decisions with BRN's institutional-grade digital asset research and analysis. Our daily market view helps you stay on top and ahead. The best part? We have nothing to sell you. Except the research.

Your Personalized View of the Digital Asset Market

Our customizable dashboard provides you with a real-time view of the key performance indicators that matter most to you. Easily track your investments, monitor market trends, and stay informed about the latest developments in the digital asset space.

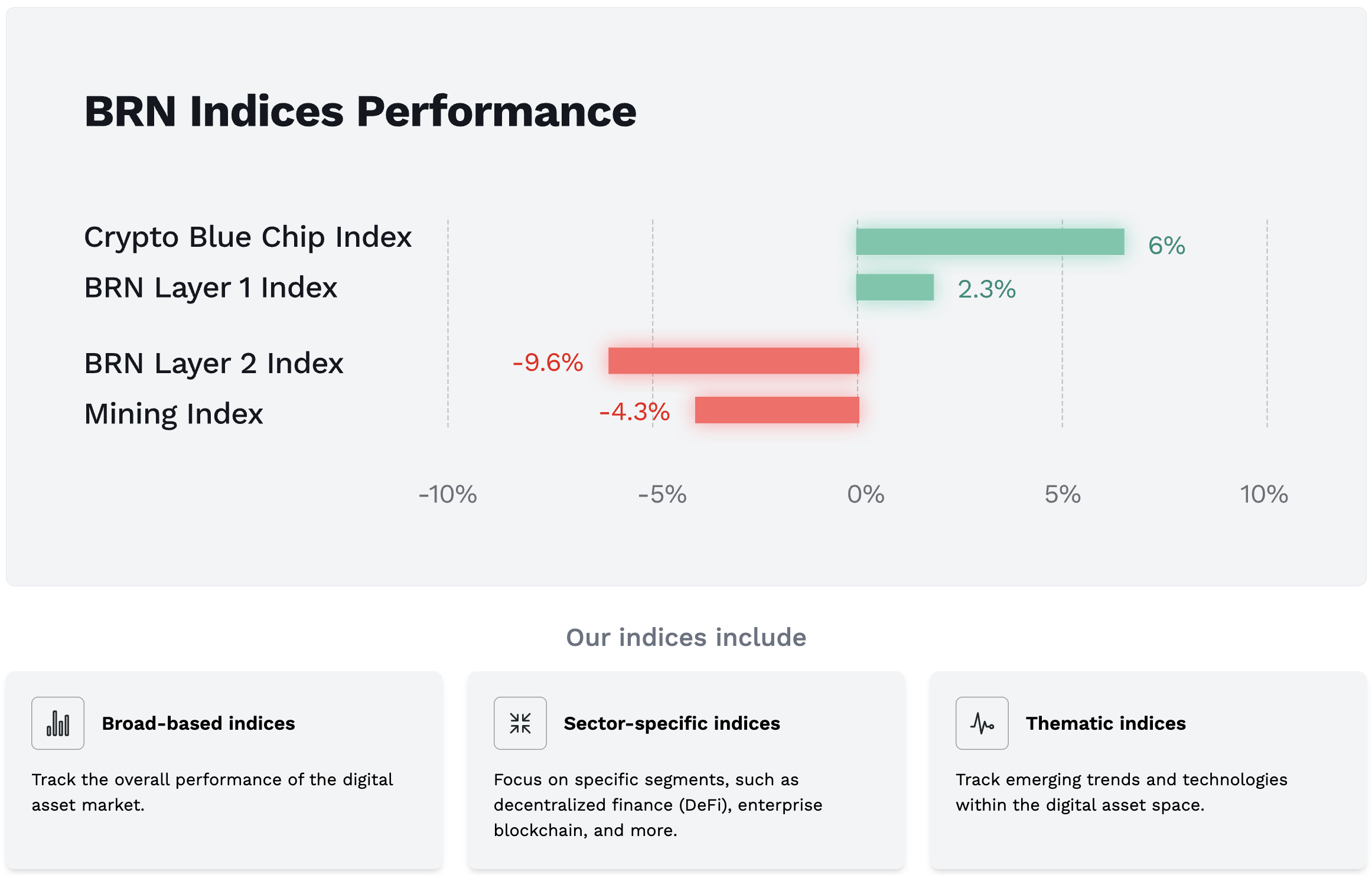

Track the Performance of Key Digital Asset Segments

Our proprietary indexes offer a unique perspective on the digital asset market, providing valuable insights into emerging trends and investment opportunities.

With BRN you can

Identify and Manage Risk

Avoid being caught off guard by sudden market movements with an informed and robust risk management strategy

Be an informed market participant

Avoid price targets driven by wishful thinking and herd mentality. Choose rational, data-driven decisions.

Diversify Your Portfolio Effectively

A well-diversified portfolio means more than just owning a handful of different tokens.